Health food store owners say that changing shopping habits – shopping more frequently and more locally – offer the biggest opportunity to boost footfall and revenues in coming years, while internet retailing currently presents the trade’s biggest threat.

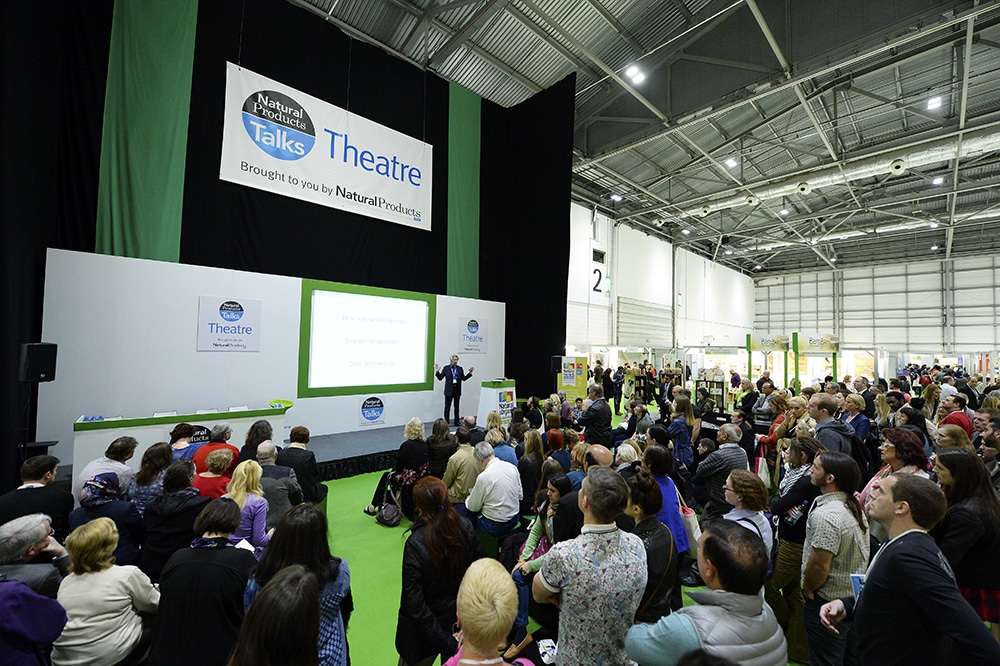

The findings form part of a newly published survey of independent natural products retailers carried out by Natural Products News and presented at last weekend’s Natural & Organic Products Europe.

Health Check: Natural Products Retailing in 2014-15 asked retailers a set of 25 questions covering everything from sales revenue to footfall, refurbishment plans to favourite suppliers.

Overall, independent retailers are optimistic about business prospects for the short to medium future. 73% of the 100 retailers polled said that their sales revenues increased in 2014, on average by 12% – taking average store revenue to £429, 605 (up from £389,162 in 2013).

On the back of this business optimism, 33% more retailers said they are now looking to expand and refurbish their stores in the next five years, while 10% more are looking to take on additional premises.

40.78% of retailers said they have an e-commerce site. Asked what proportion of total sales are made online, 66.7% said 0-10%. But there was a significant increase in the number of retailers who do 10-20% of their business online, up from 6.3% in 2013 to 11.11% in 2014.

The survey finds that 68.3% or retailers saw average customer spend increase (slightly down on 2013’s figure of 71.3%), but more retailers saw footfall increase – 53.25% compared to 44.9%.

There are some striking changes in the data on customer age. For example, there is marked increase in customers in the 35-44 and 25-34 age groups, while the proportion of customers in the 55-75 bracket has fallen sharply.

Looking at current threats to independent health food retailing, the number of retailers citing internet retailing rose sharply from 21% (2013) to 36%. Retailers were however less concerned about supermarkets and EU legislation than in 2013.

Looking at opportunities, the number of retailers citing changing shopping habits jumped from 35.5% in 2013 to 52% in 2014.

Supplements and remedies meanwhile topped the list of product categories thought to offer most potential for growth, followed by free-from, vegan and vegetarian and bodycare.

- The complete findings of the survey, which was conducted in January 2015, can be viewed here.